Therefore, the supplier has to receive those goods back and make the subsequent entry in their accounts and ledgers to ensure that they can maximize the overall returns. Record the journal the difference between assets and liabilities entries for the following purchase transactions of a retailer. Note that Figure 6.10 considers an environment in which inventory physical counts and matching books records align.

Table of Contents

ToggleIntroduction to Periodic and Perpetual Inventory

A debit memo is a document sent by a purchaser to the seller showing the amount by which the purchaser proposes to debit the seller’s account. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

3: Buyer Entries under Perpetual Method

Let us understand the importance of passing the goods purchase return journal entries from the company’s point of view. In this journal entry, both assets (inventory) and liabilities (accounts payable) are reduced by $1,500 for the purchase return transaction. The purchase returns and allowances is a temporary account which its normal balance is on the credit side. The balances of this account will offset with the purchase account and be cleared to zero when the company closes the account entries at the end of the period. When presenting the purchases figure in the financial statements, companies must account for purchase returns and allowances. Companies report these accounts as a reduction in the purchases to figure to reach net purchases.

What is your current financial priority?

Purchase return isn’t exactly a gain or an income for the company, however, it reduces liability (in case of credit purchase), therefore, it indirectly acts as a gain. Unreal Corporation purchased raw materials worth 90,000 on credit from ABC Corporation. However, at the time of delivery of the goods 5,000 worth of goods were found unfit because of inferior quality. Finance Strategists has an advertising relationship with some of the companies included on this website.

Journal Entries:

However, others may maintain both of them under the same account due to their similar nature. Regardless of its presence in the books, both accounts reduce the purchases figure in the financial statements. However, they do not directly impact the purchases account in the general ledger.

- A company, ABC Co., made total purchases of $500,000 during the last accounting period.

- If a customer made a cash purchase, decrease the Cash account with a credit.

- Some companies may keep two separate accounts for purchase returns and purchase allowances.

- The entries are listed in more or less the same manner as invoices received are entered in the purchases book.

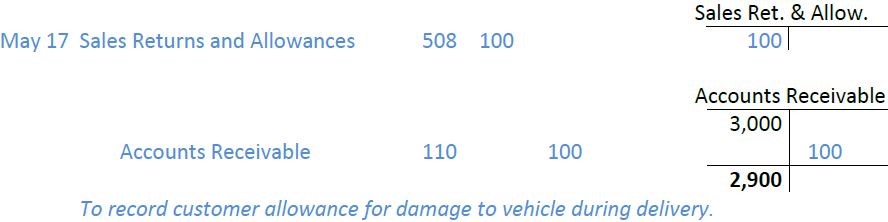

Journal entry for sales returns and allowances

Usually, companies get raw materials or finished goods from external sources. Usually, the purchase process begins with a company identifying the need to buy raw materials or finished goods. The journal entries for the return of merchandise purchased for cash and merchandise purchased on account are different. The main premise behind accounting for purchase returns is to reflect the books as if no purchase had been made initially. Rather than refunding a customer with cash, you might credit merchandise at your business. Accounting for a purchase return with store credit is similar to a cash refund.

Since we are tracking the returns through Sales Returns and Allowances, there is no need to create a contra account for Cost of Goods Sold. All the above reasons can give rise to a purchases return for companies. Sometimes, however, companies may not return goods to suppliers. For example, the goods may be faulty but still in an acceptable condition. Nonetheless, companies will require compensation in exchange for accepting below standard or faulty goods. In merchandising, a return occurs when a customer returns to the seller part or all of the items purchased.

CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund.

Since CBS already paid in full for their purchase, a full cash refund is issued. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Despite the advantages mentioned above, there are a few factors that prove to be a hassle.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. On 2 April 2016, Z Traders returned the full amount in cash to Y Merchants. We reduce the full amount owed on May 4 less the return of $350. The discount is calculated based on the amount owed less the return x 2%. The cash amount is the amount we owe – the return – the discount.